Let's get you protected.

For you and the ones you love.

Life Cover

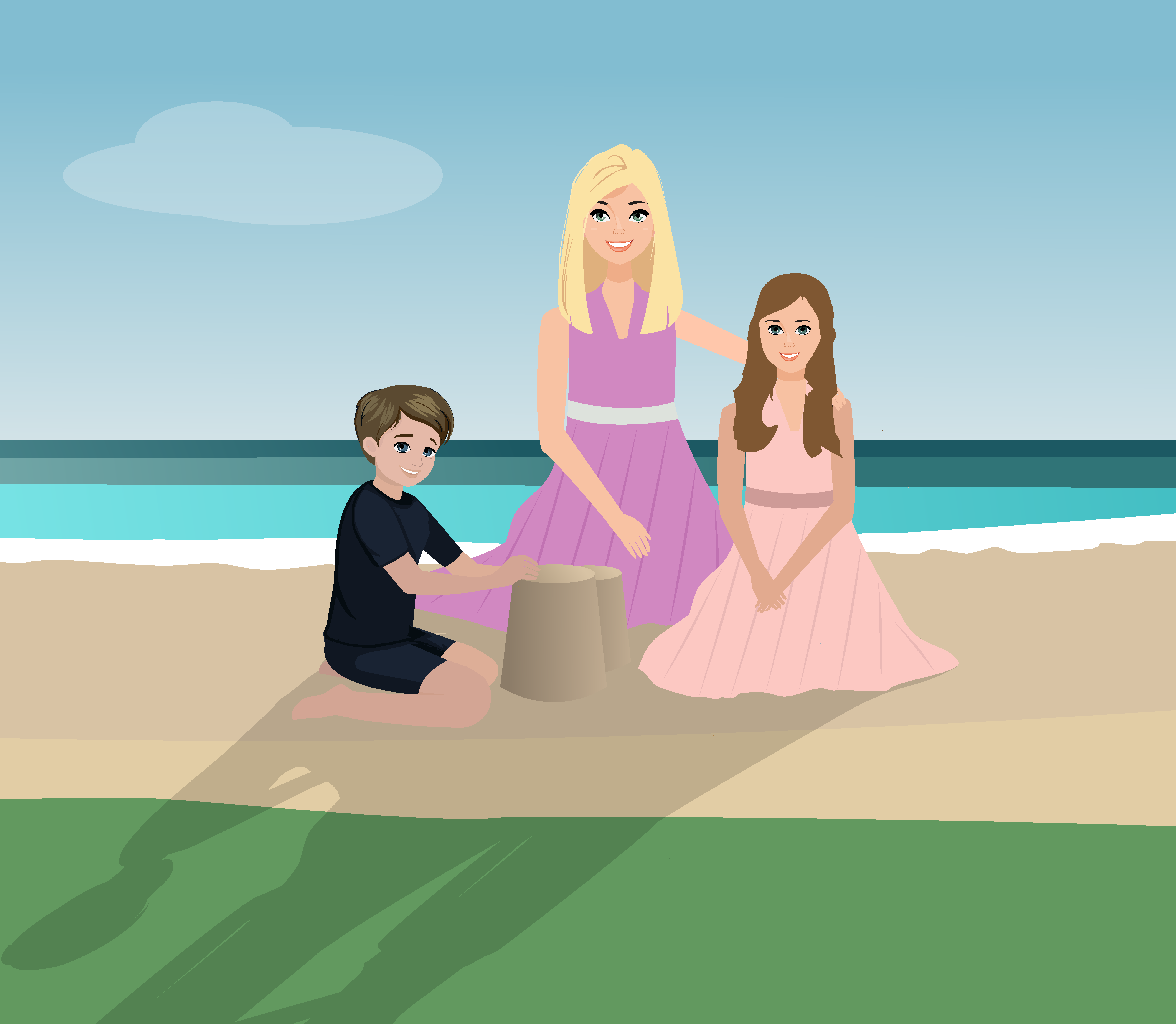

Life Cover insurance is a bit like a safety net for your loved ones. It's a financial plan that can help protect your family if the unexpected happens. Think of it as a way to provide them with a financial cushion, so they can focus on coping with their loss and not worry about money.

It works like this: you pay a small amount each month, and if you pass away, your family will receive a lump sum payment. This money can be used to cover important expenses like a mortgage, rent, bills, and everyday living costs. It can also help with things like funeral costs and childcare.

Life cover insurance can offer peace of mind, knowing that your family is financially protected. It's especially important if you have dependents, like children or a partner, who rely on your income. Even if you don't have a big family, it can still be a valuable way to take care of your loved ones.

Remember, Life Cover is a personal decision. Come and talk to us and we'll help you to find the right type of cover for you and your family's needs.

Critical Illness Cover

Critical Illness Cover can help protect you and your family financially if you're diagnosed with a serious illness.

Here's how it works: You pay a monthly premium, and if you're diagnosed with a covered illness, you'll receive a lump sum payment. This money can be used to cover medical costs, lost income, or other expenses related to your illness. It can also help you and your family maintain your lifestyle during a difficult time.

Critical illness Cover can be a valuable addition to your financial plan, especially if you have dependents or a mortgage. It can provide peace of mind, knowing that you and your family are protected if the worst happens.

Remember, it's important to choose a policy that covers the illnesses that are most relevant to you. You should also consider factors like the amount of coverage you need and the length of the policy term.

Income Protection

Income Protection insurance is designed to provide financial support if you're unable to work due to illness or injury.

Here's how it works: You pay a monthly premium, and if you're unable to work, you'll receive a regular income payment. This can help cover your living expenses, such as rent or mortgage payments, bills, and everyday costs.

Why is it important? Well, if you're the main breadwinner, your family relies on your income. If you're unable to work, it can put a significant strain on your finances. Income Protection insurance can help alleviate this stress by providing a steady income stream.

It's also worth considering that many illnesses or injuries can take longer to recover from than you might expect. Income Protection can bridge the gap between your recovery and your return to work.

Remember, the best time to consider Income Protection insurance is when you're healthy and able to work. By taking proactive steps to protect your income, you're ensuring your family's financial security, no matter what life throws your way.

Whole of Life Benefit

Whole of Life insurance is a type of life insurance policy that provides lifelong coverage. Unlike Life Cover insurance, which covers you for a specific period, Whole of Life insurance - as the naming suggests - is designed to last your entire lifetime.

Here's how it works: You pay regular premiums, and when you pass away, a lump sum payment is made to your beneficiaries. This money can be used to cover various expenses, such as funeral costs, outstanding debts, or to provide financial support for your loved ones.

Why is it important? Whole of Life insurance offers several benefits. It provides peace of mind knowing that your loved ones are financially protected, regardless of when you pass away. It can also be used as a valuable tool for estate planning, helping to cover inheritance tax liabilities or ensuring a legacy for your family.

While Whole of Life insurance can be a valuable financial tool, it's important to consider your individual needs and financial situation. Booking in a chat with us can help you determine if Whole of Life insurance is the right choice for you.

Family Income Benefit

Family Income Benefit (FIB) is a type of life insurance that provides a regular monthly income to your family if you die or are diagnosed with a terminal illness. This can be a lifeline for your loved ones, helping them to maintain their lifestyle and cover essential expenses.

Unlike traditional life insurance, which pays out a lump sum, FIB provides a steady income stream. This can be particularly helpful for families with young children or those with significant financial commitments, such as a mortgage or rent.

By choosing the right level of cover and term length, you can ensure that your family is protected for as long as they need. FIB can offer peace of mind, knowing that your loved ones will be financially secure, even in the face of adversity.

Buildings & Contents Insurance

Buildings & Contents insurance is protection for your home and belongings. It's designed to protect you financially if something unexpected happens, such as a fire, flood, or burglary.

Buildings insurance covers the structure of your home, including the walls, roof, and plumbing. It can help with the cost of repairs or rebuilding if your home is damaged or destroyed.

Contents insurance covers your belongings, such as furniture, electronics, and personal possessions. It can help replace these items if they're lost, stolen, or damaged.

Why is it important? Having Buildings & Contents insurance can provide peace of mind, knowing that you're protected against unforeseen events. It can help you avoid significant financial hardship and stress during a difficult time.

It's important to choose the right level of cover to ensure that you're adequately protected. You should consider factors like the value of your home and belongings, and any specific risks that may apply to your property. You can also add extra cover for more valuable or personal belongings.

Accident, Sickness & Unemployment Insurance (ASU)

Accident, Sickness & Unemployment (ASU) insurance is designed to protect your income if you’re unable to work due to illness, injury, or redundancy. ASU can help cover essential outgoings such as your mortgage payments, household bills, or everyday living costs, giving you peace of mind during unexpected periods of financial difficulty. At Naomi Financial, we help you find the right ASU policy to suit your lifestyle, budget, and financial responsibilities.

What Is ASU Insurance?

ASU (Accident, Sickness & Unemployment) insurance provides short-term income protection if you are unable to work because of:

- An accident or injury

- A medical condition or illness

- Redundancy or involuntary unemployment

Policies usually pay out a monthly benefit for a set period (typically 12–24 months) until you return to work or the claim period ends.

ASU is often used to help cover:

- Mortgage or rent payments

- Household bills

- Loan repayments

- Everyday living costs

- Temporary financial shortfalls

How ASU Insurance Works

- You choose a monthly benefit amount that fits your financial needs

- After a claim is approved, the policy pays a tax-free monthly benefit

- Payments continue for the duration of the claim period or until you return to work

- Waiting periods (deferred periods) may apply before payments begin

- Policies can be structured for term life, critical illness, or combined cover

Benefits of ASU Insurance

ASU insurance can provide:

- Financial security if you’re unable to earn an income

- Help meeting essential bills, including mortgage payments

- Short-term support while you recover or search for new employment

- Peace of mind for you and your family

- Flexible cover options to suit your job type and budget

Things to consider

Before taking out ASU insurance, it’s important to understand:

- Cover typically lasts for a limited time period (e.g., up to 12–24 months)

- Pre-existing medical conditions may be excluded

- Redundancy cover may have qualifying periods before it becomes active

- Policy terms and benefits vary significantly between insurers

- It is essential to choose the right level of cover for your income and financial commitments

Alternatives to ASU Insurance

Depending on your circumstances, you may want to explore:

- Income protection insurance (longer-term cover)

- Mortgage payment protection insurance (MPPI)

- Critical illness cover

- Employer sick pay or redundancy packages

- Using savings or emergency funds

Why choose Naomi Financial for ASU Insurance?

At Naomi Financial, we provide independent, tailored advice to help you find the right protection for your needs. We take the time to understand your income, financial commitments, and personal situation, guiding you toward the most suitable ASU or income protection solutions available.

Protecting your income means protecting your lifestyle, your home, and your peace of mind.

Private Medical Insurance (PMI)

Take control of your healthcare with Private Medical Insurance. At Naomi Financial, we make it simple to understand your options so you can choose cover that fits your life, your priorities, and your budget.

PMI gives you access to private healthcare for eligible conditions, with the opportunity to choose where you’re treated and who treats you. Depending on the policy, you may benefit from outpatient appointments, diagnostic tests, specialist consultations, hospital treatment, and a range of additional support services.

Every insurer offers something different, so understanding the details is key.

Why consider PMI?

- Greater choice of hospitals and specialists

- More flexibility around appointments and treatment pathways

- Access to a wide range of private healthcare services

- Options to tailor your cover to your needs

How Naomi Financial supports you

We help you explore PMI options offering clear and transparent information so you can compare features, understand costs, and feel confident in your decision. We don’t push any particular insurer — you stay in control of your choices.

Relevant Life Cover

Business Protection Insurance, also known as Relevant Life Insurance, is a tax-efficient way for businesses to protect key employees or directors in the event of death, critical illness, or disability. It ensures that your business, your employees, and their families are financially protected while supporting the long-term stability of your company. At Naomi Financial, we provide expert advice to help you find the most suitable business protection solutions for your company.

What is Business Protection (Relevant Life) Insurance?

A Relevant Life policy is a life insurance policy taken out by a business on the life of an employee, director, or key person. The business pays the premiums, and in the event of a claim, the death or critical illness benefit is paid tax-free to the business or nominated beneficiaries.

Business protection can help in situations such as:

- Replacing a key person whose absence would impact profits

- Protecting business loans or liabilities

- Providing financial support for families of directors or employees

- Covering shareholder or partnership agreements in the event of death

How Relevant Life Insurance works

- The business takes out the policy and pays the premiums

- The insured individual is typically a director or key employee

- The policy pays out a lump sum if the insured dies or is diagnosed with a critical illness

- Benefits are usually tax-free to the business if set up correctly

- Policies can be structured for term life, critical illness, or combined cover

Benefits of Business Protection / Relevant Life Cover

Relevant Life Insurance offers several advantages:

- Protects key employees and the business against financial risk

- Provides a tax-efficient way for small and medium-sized businesses to offer life cover

- Helps with business continuity planning

- Supports shareholder agreements, partnership buyouts, or loan repayments

- Gives peace of mind to employees and their families

Things to consider

Before arranging business protection, consider:

- Cover is for individual employees or directors, not general staff groups

- Eligibility criteria may apply, including age and health checks

- Policies are usually term-based and end when the term expires

- Careful setup is required to ensure tax efficiency

- Premiums and benefits vary depending on age, health, and the sum insured

Alternatives to Relevant Life Insurance

Depending on your business and financial planning needs, alternatives may include:

- Key Person Insurance

- Shareholder Protection Insurance

- Partnership Protection Insurance

- Group Life Cover for employees

- Business Loan Protection

Why choose Naomi Financial for Business Protection?

At Naomi Financial, we provide independent advice tailored to your company’s needs. We help you identify which directors, employees, or key people should be covered, the level of protection required, and the most suitable policy options. Our aim is to provide peace of mind for your business and its stakeholders.

Protecting your business today ensures stability for tomorrow.